The Path to Ranked Trader

Achieving and maintaining “Ranked” status is proof of consistency, discipline, and profitable trading. It’s proving that you have a quantifiable edge.

Data Analysis

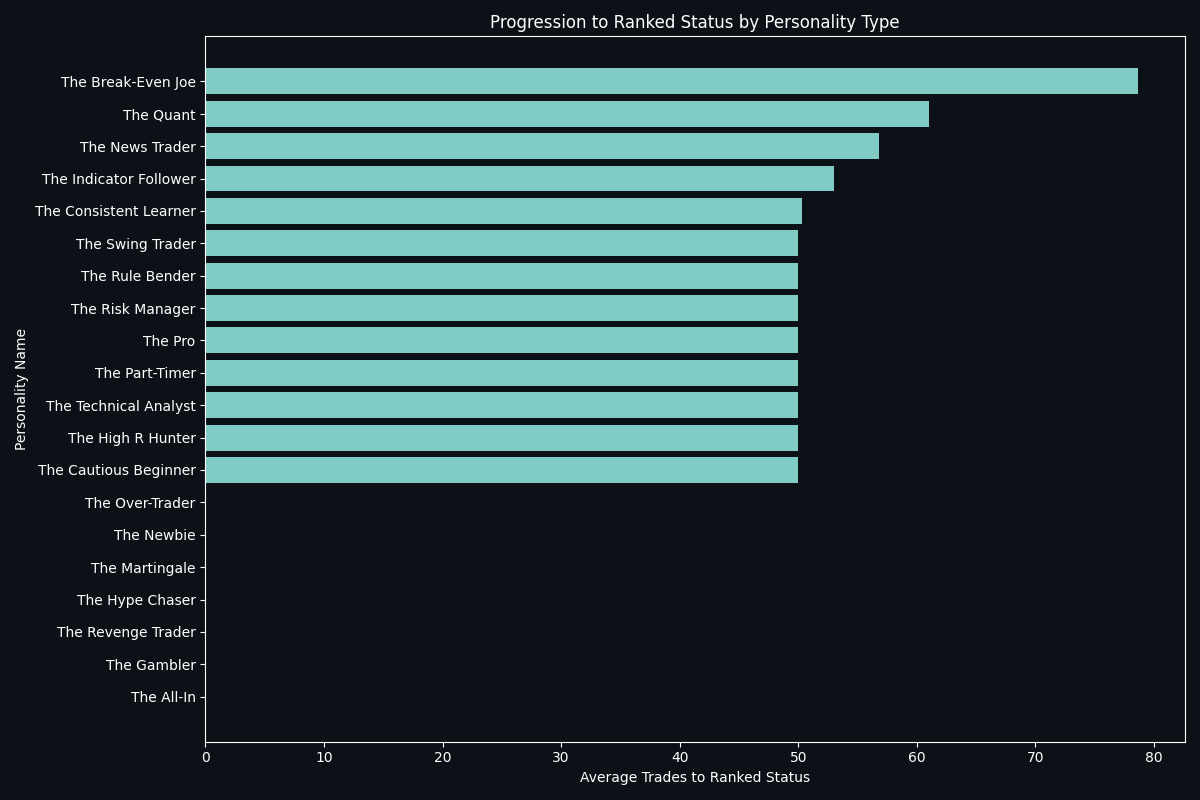

The scoring algorithm is tested against a 6-month simulation of 10,000 traders with varying skill and personality types.

How Algorithmic Scoring Works

The algorithm measures multiple elements of trading skill. The goal is to score genuine analytical ability.

-

Directional Accuracy Did the market move in your predicted direction (Long or Short) before the candle closed? Basically you are predicting if the candle will close below or above the chosen candle’s open.

-

Risk/Reward Management Having a trade plan is instantly rewarded but achieving R:R targets provide a more significant multiplier.

-

Timing & Conviction The system includes a time-decay model. Analysis and trade submissions submitted earlier in a candle’s formation get a higher potential score than those submitted just before it closes, rewarding analytical skill and foresight.

-

Risk Control The algorithm caps the maximum R-multiple based on the timeframe chosen to prevent a single lucky, high leverage trade, promoting consistent risk management.

Ranked Eligibility Criteria

These are designed to ensure you have a sufficient track record of consistent, profitable, and disciplined analysis.

Tier 1: Foundational Requirements

- Minimum 50 Scored Analyses: This is the directional bias that you can submit without a trade plan calling whether a candle will close above or below it’s open.

- 50% Trade Plan Mandate: Once you reach 50 scored analyses, the system will check if at least half of your analyses have full trade plans. This proves your ability to trade your directional bias.

- 20-Day Activity Window: Your submissions must be spread over 20 days to demonstrate consistency.

Tier 2: Performance Metrics

- Positive Total R: Your cumulative R-multiple from all trade plans must be greater than zero.

- Profit Factor > 1.25: The sum of your winning R must be at least 25% greater than the absolute sum of your losing R.

- Positive Total Score: Your overall platform score must be positive, proving holistic skill.

Tier 3: Consistency & Risk Management

- No Single Trade Dominance: No single trade can account for more than 40% of your total positive R earned. This filters out luck.

- Consistency Score > 0.1: Your "Sharpe-like" ratio (Average R / Std Dev of R) must be positive, rewarding steady returns over wild swings.